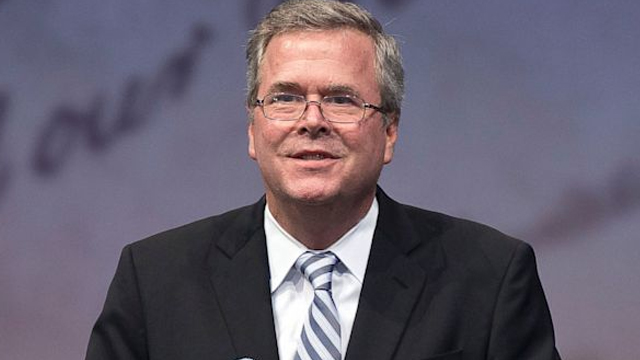

While most Republican contenders in the presidential derby are playing the same old tax song, Jeb Bush, former governor of Florida, is singing a slightly different tune.

On September 9, the brother of President George W. Bush and son of President George H. Bush unveiled his long-awaited tax reform plan against the backdrop of a North Carolina factory. Unlike other approaches from his conservative brethren, Bush went out on a limb in proposing sweeping changes that would slash taxes for millions of low-income individuals, not just the upper crust and corporations.

According to estimates quoted in the Washington Post and other media sources, Bush’s plan would cost the federal government $1.2 trillion in tax revenue, based on the findings of his financial advisors after factoring in potential growth from the changes. A more traditional analysis indicates a loss closer to the $3.4 trillion mark.

For individual taxpayers, Bush would replace the current seven-bracket system with just three tiers of 10 percent, 25 percent and a top rate of 28 percent (down from the current 39.6 percent high), in addition to eliminating the marriage penalty. Naturally, he called for repeal of the alternative minimum tax (AMT), a standard rallying cry among Republicans. But he would also limit mortgage interest deductions to just 2 percent of adjusted gross income (AGI) and wipe out deductions for state and local income taxes, not likely to win him any favors from residents of high-tax states. Deductions for charitable gift-giving would remain untouched.

Both the standard deductions and the earned income tax credit (EITC) would be nearly doubled, so roughly 15 million more Americans would not have any tax liability at all. About 42 million families overall would benefit from the tax cuts.

On the business side, Bush proposed a reduction in the top corporate tax rate from 35 percent to 20 percent. He also said he would provide incentives to invest in U.S. businesses, relying on projections of expansion to prop up the estimated loss of tax revenue. Furthermore, he would assess a one-time tax on corporate funds being stashed overseas and eliminate interest deductions for corporations.

Like the other Republican presidential challengers, Bush has vowed to reform and simplify the big, bad tax code. “It punishes people for doing things we should encourage and rewards people for doing things that may not be good,” said Bush. “ It taxes paychecks hard but gives companies a write-off for debt. The current tax code makes it easier to borrow than build. I believe it’s time we build for the future, not borrow from it.”

Finally, echoing recent remarks from Republican frontrunner Donald Trump, Bush said he would close loopholes for hedge fund managers who can report earnings as capital gains instead of ordinary income. It’s another sign he is moving away from the far right and distancing himself from the failed campaign of 2012 GOP candidate Mitt Romney. With Donald Trump, the leading Democratic in the polls, Hillary Clinton, and now Jeb Bush all in agreement on this particular issue, politics and taxes can sure make strange bedfellows.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs